HAPPY NEW YEAR and I hope that 2007 will be a wonderful year for everyone!

Today I am going to tell you a wonderful site which might turn to be next Youtube.com or Myspace.com but the difference is you can own that company?!

I want to introduce to you about AGLOCO. Do you realise how valuable we are?Advertisers, search providers, and online retailers are paying billions to reach you while you surf. Howmuch of that money are you getting? Zilt, so far that is........ZERO!

I hope we all can build up a community and get some money while surfing the internet!

Here is why I would like you to consider joining:

1. AGLOCO pays you, as an Internet user, your fair share of the value created while you surf.

2. The AGLOCO's free software puts you in control of what arrives on your screen and what data you allow outsiders to collect.

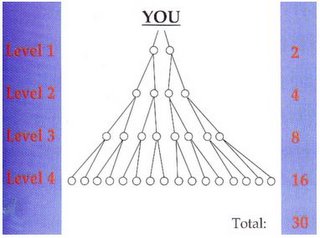

3. AGLOCO is a 100% Member owned company which rewards the Members who help build the company. It never costs anything to be a Member AGLOCO is only four weeks old and it has already signed up tens of thousands of Members and has created enormous Internet 'buzz' (over 700,000 pages in Google's search talk about AGLOCO).

AGLOCO is not a 'get rich' quick scheme. Every additional Member raises the value of all the Members, so we all get more if you join.

It is free to join and Membership never costs anything. Click here to read more and sign up now. CLICK NOW TO JOIN!

Thanks

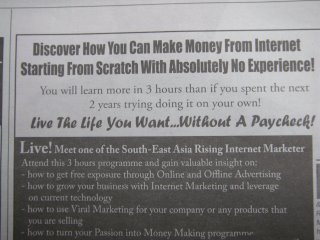

' I desperately needed money at that time!'

' I desperately needed money at that time!'

'Place where you can make or lose money!'

'Place where you can make or lose money!'

" Should I buy this house?"

" Should I buy this house?"

" Where to put your money?"

" Where to put your money?"